Tokens custody

In the intangible digital asset context, custody is typically associated with ownership and control over a digital wallet and its assets. Depending on how much responsibility should be given to users regarding custody and control over their assets, retaining custody of them or allowing someone else to do so are viable options.

Digital assets such as tokens are created and transferred between owners using cryptography and a decentralized blockchain network. Owners acquire tokens in transactions recorded on the blockchain, and those transactions are typically the only documentation of the assets’ existence. The owners are issued cryptographic keys that prove their ownership of the tokens to be used when transferring them between owners or using them to buy things.

So, technically, custodians don’t store the tokens themselves; they store the owners’ cryptographic keys. Those keys must be protected to ensure the owner’s tokens are safe. If they are lost or stolen, the tokens may be unrecoverable.

At the core of tokens' custody is the concept of a wallet, which in this case means the place where an asset owner’s cryptographic keys are stored. At a minimum, all wallets store two related types of keys: private and public. These keys are used together to securely complete each transaction, such as a token purchase.

Wallets can take many forms, using a variety of methods to store and secure private and public keys and typically applying access controls such as passwords or passphrases. Some wallets are designed to store a single cryptocurrency, but many can store multiple tokens.

Custodial Crypto Wallets

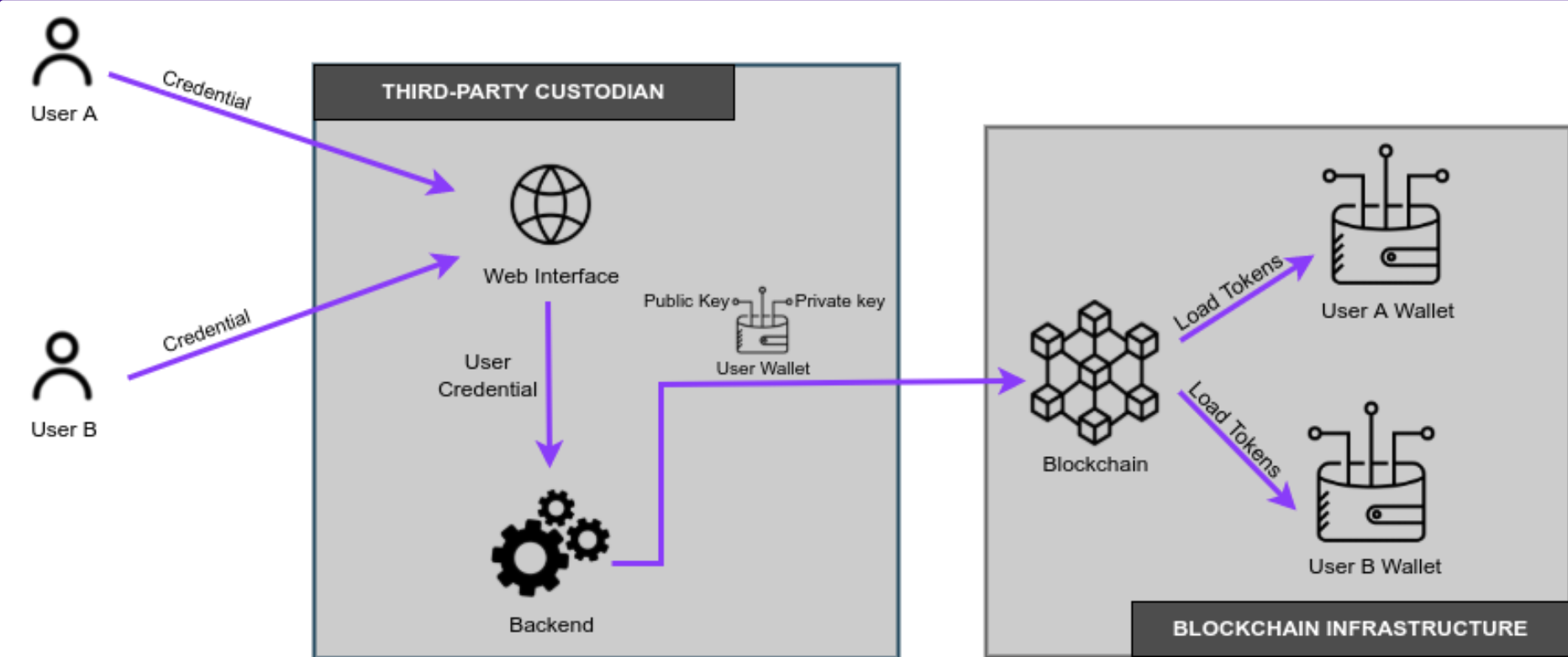

The working of a custodial wallet is similar to that of a bank where the money stored in a customer's account is theirs but is controlled by the bank. In custodial wallets, a third party holds all of a user's sensitive data and assets, including the wallet's private key. This third party can be an NFT market, an exchange, or a custodial wallet provider. They are usually considered to be the most user-friendly and easy to set up.

Wallets provided by custodians manage the keys on behalf of the owner. With some custody offerings, the owner may not know or have direct access to the private keys. If the owner forgets their password, the custodian can verify their identity so they can regain access and ensure they don’t lose their digital assets.

Custodial wallet.

Custodial wallets are where you don’t truly ‘own’, in cryptographic terms, the contents of the wallet since you can never access it outside the walled garden of the custodian.

Pros

- It does not require users to have strong crypto assets security knowledge as a third party is in charge of protecting all users' crypto-assets.

- The existence of a third-party custodian can be helpful in ensuring a user does not lose access to their funds.

- Custodial wallets are often a requirement if a user wants to trade on the most popular cryptocurrency exchanges.

- Some custodians will offer a return on users' cryptocurrency-based savings.

- As users can only use login/password to access their wallets, they are spared from understanding more complex crypto concepts like seed words

Cons

- Users don’t own their private keys, which means security is being left up to a third party.

- Someone else is holding the users' money, which means they could decide to simply take it.

- Custodial wallets operate very similarly to the traditional financial system due to the fact that they are centralized.

- A user may not gain access to new cryptocurrencies that are created via forks of cryptocurrencies that he already holds.

Non-Custodial Crypto Wallets

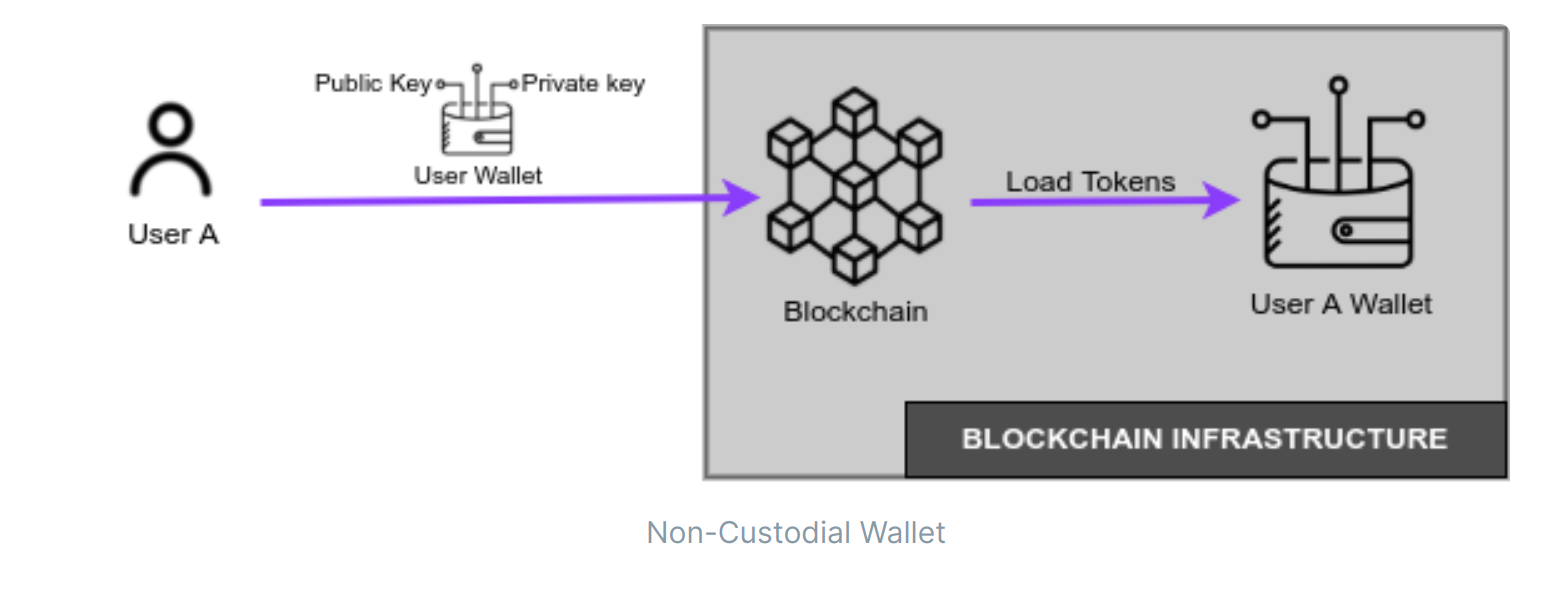

Owners that prefer to manage their own digital assets, as opposed to relying on a custodian, may use a personal wallet such as a hardware device that stores their keys. This gives them more control over the keys, but it also places greater responsibility on them to protect those keys, and their password, from loss or theft. Non-custodial wallets can be less user-friendly for new users who aren’t familiar with crypto specifics.

Non-Custodial wallet.

Pros

- Users are in complete control of your cryptos, which means the assets are much more difficult to seize.

- Non-custodial wallets do not require KYC procedures so users can remain anonymous.

- Transactions are reflected on the chain in real-time in Non-Custodial wallets.

Cons

- It will be more difficult for a user to trade his cryptocurrency quickly, as it will first need to be sent to an exchange.

- A user will be in charge of his own security and human error could lead to theft or accidental deletion.

- If a user loses their private key, a non-custodial wallet will not be able to recover access to their wallet.

Which One is Better?

Both types of wallets have their benefits and limitations. Ultimately, the choice may be up to the user or use case requirements. Custodial wallets are easier to deal with, and more convenient if you’re looking to move assets or participate in the markets. But the fear of major problems like attacks should be enough to make one wants a second, non-custodial cold wallet, to store what one wants to keep for the long term.